When Farfetch launched in 2008 as an e-commerce marketplace for small boutiques around the world, it encountered opposition from the most notable luxury fashion houses. Today, the same brands sell on the Farfetch Marketplace, which connects customers in 190+ countries with products from 50+ countries and 1,400+ brands, boutiques, and department stores. We analyse how network effects contributed to Farfetch becoming a top luxury e-commerce platform despite initial scepticism.

As a marketplace, Farfetch acts as a virtual connector, matching brands (supply) with shoppers around the world (demand) and overseeing all aspects of the digital trading experience. For two-sided marketplaces to scale a powerful phenomenon, called “network effects”, needs to take place.

“Network effects refer to any situation in which the value of a product, service, or platform depends on the number of buyers, sellers, or users who leverage it”

In the case of Farfetch, the more customers, luxury boutiques, and brands it attracts, the more attractive the platform becomes for all parties.

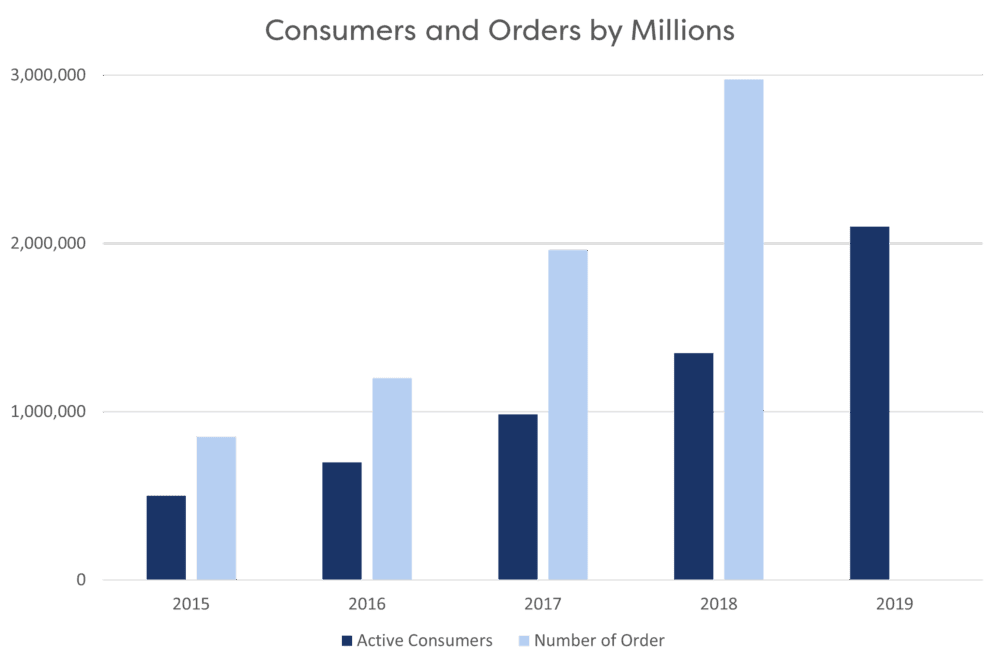

Network effects kick in once marketplaces reach an inflection point, after which growth follows an exponential trajectory. This is known as “critical mass.” For Farfetch, it refers to the point at which it had amassed a large and active user base, attracted significant investments, and reached a level of recognition that allowed it to become a dominant player in the market. While it's challenging to pinpoint an exact date for this achievement, two early key milestones in Farfetch's history marked its growth and influence:

For Farfetch, it refers to the point at which it had amassed a large and active user base, attracted significant investments, and reached a level of recognition that allowed it to become a dominant player in the market. While it's challenging to pinpoint an exact date for this achievement, two early key milestones in Farfetch's history marked its growth and influence:

Additionally, in August 2022, Farfetch and Richemont announced a deal: Richemont agreed to sell a 47.5% stake in Yoox Net-A-Porter (YNAP), a luxury e-commerce rival, for over 50 million Farfetch shares, with an option for full acquisition in 3-5 years. This move aimed to boost Farfetch's luxury e-commerce standing, potentially adding $3 billion in gross merchandise volume by leveraging YNAP’s brands and widening Farfetch’s product range.

When it comes to network effects, marketplaces are usually subject to the chicken-and-egg problem: to attain a critical mass of buyers, a critical mass of suppliers is required — but attracting suppliers requires a significant buyer base. Since its inception, and for the initial five years of its existence, Farfetch faced strong resistance from most luxury fashion houses regarding e-commerce. Therefore, Farfetch strategically prioritised building a reputable supply of luxury goods. A growing assortment from luxury brands would not only attract customers seeking high-end fashion but also entice other luxury brands to join in.

“It was me, jumping on a plane to Paris, going to Milan and trying to beg them, beg them, to let us have a chance at survival.” – José Neves, Founder

Over the years, Farfetch scaled with presence in new markets, strategic partnerships with brands like Richemont, and acquisitions such as Browns and New Guards Group. It also began to build up its platform solutions business, offering a compelling and easy logistics service to some of the biggest luxury brands, starting with Jason Wu in 2015.

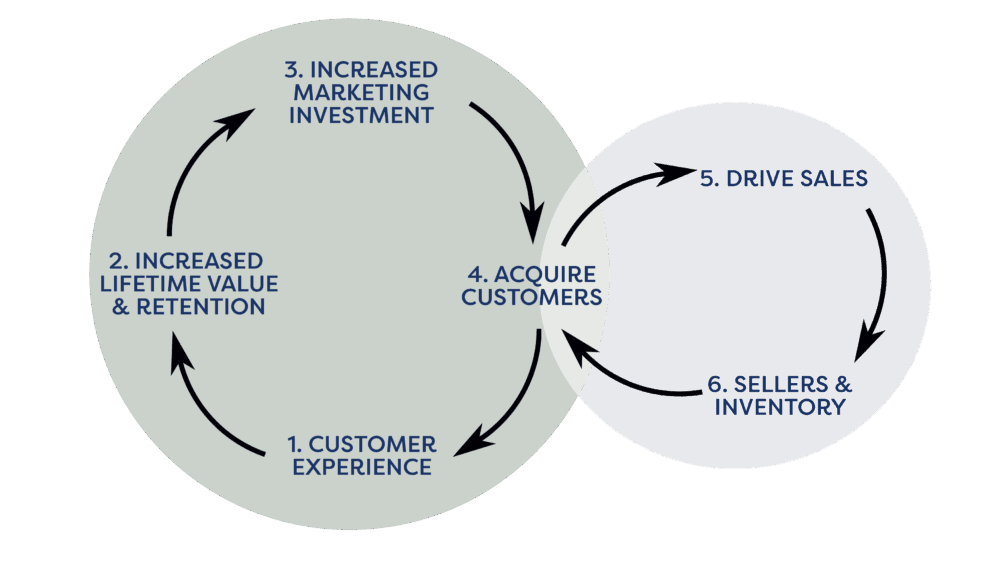

This model shows how the Farfetch marketplace works, particularly focusing on the demand side of the network. Customer experience improvements are leveraged to consistently drive traffic, improve the selection of goods and cost structure, decrease prices, and contribute to the flywheel spin.

Since its 2018 IPO, Farfetch has experienced a steep financial decline, with shares plummeting over 80% from a peak of $73.40 in February 2021 to $2 in November 2023, as many expansion efforts faltered. 2023 was particularly challenging, marked by a declining sales and significant struggles across its various divisions. New Guards Group, responsible for licenses like Off-White and Palm Angels, saw a 40% year-over-year revenue drop in Q2 2023. Additionally, Farfetch closed its beauty division in August 2023 due to shopper attention challenges and is divesting Violet Grey, a cosmetic retailer acquired for $50 million in January 2022, to enhance its beauty ambitions.

Farfetch’s acquisition binge expanded its scale; however, this growth has led the company to deviate from its initial vision as a fashion tech platform. This serves as a cautionary tale for entrepreneurs navigating substantial funding, underscoring the critical importance of maintaining focus on the core mission and vision amid rapid expansion. Consequently, some investors argued that Farfetch should prioritise revitalising growth in its core marketplace, streamline its white-label e-commerce services, and consider divesting its New Guards Group unit.

“The fashion industry and the financial markets no longer understand the company’s increasingly complex vision and have little faith that the company, which has never consistently made a profit, can get back on track.” – Imaran Amed, Founder & CEO, The Business of Fashion

In December 2023, Coupang, a South Korean e-commerce giant, announced the acquisition of Farfetch for just $500 million, following Farfetch’s reported liquidity of over $800 million four months prior. Disgruntled investors holding Farfetch’s convertible bonds have filed a suit to liquidate Farfetch Limited, aiming to recover $404 million in losses.

Just two weeks after the acquisition closed, in February 2024, Coupang announced a massive executive shake-up, including the departure of the marketplace’s founder, chairman and CEO, José Neves, along with several other key executives such as the CFO, CPO, COO, CMO, and the chief fashion & merchandising officer who’s also the CEO of Browns. The executive streamlining signals a company repositioning for financial strength, but Farfetch’s future under Coupang’s ownership remains uncertain, disrupting already strained relationships in the fashion industry. Neiman Marcus Group is terminating its commercial partnership with Farfetch, which involved re-platforming the Bergdorf Goodman website and app via Farfetch’s Platform Solutions software. Additionally, Kering is withdrawing all its brands, such as Gucci, Saint Laurent, Bottega Veneta, Balenciaga, from the Farfetch marketplace.

This article was originally published in November 2023 with updates in February 2024.